Licensing software on a subscription basis is continuing to grow in popularity. This is disrupting legacy software infrastructure, with its limiting terms and conditions. In fact, most new companies are skipping legacy software and starting off with software as a service (SaaS) systems, resulting in steady growth in the sector.

To help you understand the state of SaaS in 2023, we’ve put together some vital SaaS statistics and trends you need to know.

Let’s get started.

1. The global SaaS industry is projected to grow to $195.2 billion in 2023 (Source)

This follows an upward trend that saw the industry reach $167.1 billion in 2022.

There are a variety of reasons for the increase in spending, most of them economic in nature.

According to Gartner VP Analyst Sid Nag, global financial conditions, higher inflation, and counter-inflation measures are the primary cause of higher SaaS and cloud spending.

For SaaS services, especially those with a major base on the ground (physical servers and in-house infrastructure), staff shortages and the need to protect financial margins are causing higher spending.

However, the increase can be seen as a general upward trend in that companies the world over are entering the SaaS space and organizations are replacing legacy software with subscription-based cloud offerings.

Another reason for industry growth is that newer end users such as startups use almost completely SaaS-native infrastructure. In other words, they’re growing up with SaaS instead of adopting it in place of legacy systems.

If the number of startups continues seeing an upward trend in the near future, we may see SaaS revenue climb even higher than initially projected.

2. The SaaS market size has increased 521.6% since 2015 (Source)

This is part of a long-term observation and takes into account several shifts in market attitudes toward cloud-based vs on-ground services.

Growth has been steady, despite the massive industry upheaval the pandemic brought.

The two biggest observable reasons for the rapid growth are:

-

- The subscription-based model may be cheaper for companies who prefer to pay as they go, or only pay for specific functionality. For example, a small to medium-sized company may only need a process management solution. Instead of paying for on-premises software with a limiting contract and features they don’t need, they could simply subscribe for that one function.

-

- SaaS solutions offer automated updates and constant service improvements. Unlike legacy software that requires the purchase of a new version every time one comes out, you could continue working with SaaS models and experience improved function automatically.

Incidentally, the customer resource management (CRM) sector is among those experiencing the most growth. The two reasons for growth we mentioned apply directly to companies in the SaaS space.

3. Revenue in the SaaS sector is projected to reach $253.9 billion in the US during 2023 (Source)

This is the result of a compound annual growth rate (CAGR) of 7.98%, which will see revenue climb to a projected $344 billion by 2027.

The per-employee spend is also projected to see growth within the SaaS segment. This can be seen as an offshoot of the already climbing spending rates in the segment as a whole. However, there are several specific reasons for higher spend on individual employees.

Firstly, staffing shortages have led to companies agreeing to restructure payment policies on the hiring and remuneration front. This means that SaaS companies are now more likely to spend higher on each employee as the years pass by.

This isn’t bad for the companies themselves. In most cases the growth in revenue can support paying employees more.

While we can make projections on revenue strictly in SaaS marketing, employee spending is a whole other world with its own variables.

4. Net growth in SaaS app usage is up 18% in 2023 (Source)

Despite the slight decrease in usage growth, larger companies and organizations are still using an average of around 130 SaaS apps.

The start of the 2010s saw a boom in the popularity of cloud-based SaaS applications in almost all industries. This growth has slowed down a little over the years.

Market concentration and lots of great existing solutions may be reasons for new companies not entering the space. Regardless, global industries are always expanding. There’s always a demand for new, more innovative, and more cost-effective solutions.

That demand comes with a constant state of new adoption.

However, with higher levels of adoption you see new challenges and user pain points. Not every software solution is going to be optimal for every application.

What’s helpful for both the SaaS industry and the end users is that SaaS companies can now work on two things simultaneously. They can continue to innovate and offer solutions for legacy problems while improving their own software offerings.

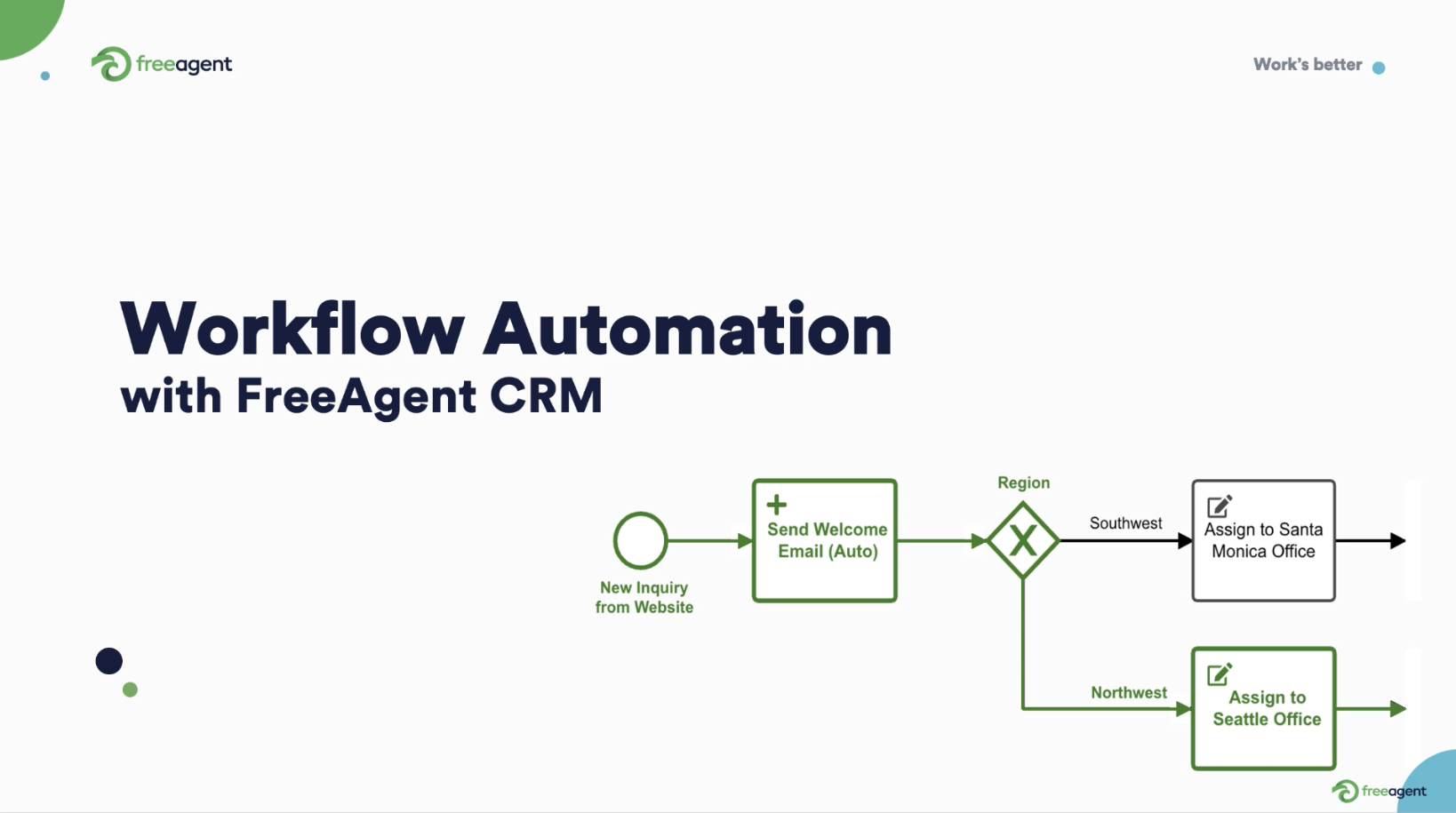

5. 86% of IT professionals believe automation is key to effective SaaS operation management (Source)

It’s no surprise that automating processes is the logical next step for companies looking to streamline them.

However, SaaSOps is still a major hurdle obstructing smooth sailing on SaaS app adoption and automation.

Today’s companies still have a pretty manual process of discovering new SaaS apps, managing access and security, and managing employees on the apps. Automating this could be effective in freeing up some much-needed resources for important things like service improvement and hiring.

Once you consider the challenges, automating the process makes sense. Yet around 64% of IT professionals say they lack visibility and insight to effectively implement automation.

BetterCloud’s 2023 State of SaaSOps found that many companies believe zero-touch automation to be the actual future of SaaS. This means the entire SaaSOps workflow can be automated with no manual IT touchpoints in between.

However, considering that we still lack a complete understanding or knowledge of automation challenges, this looks like the next-next step after first-stage automation.

6. 72% of IT professionals say zero-touch SaaS automation is the future (Source)

As mentioned in the previous point, companies are looking to eliminate IT prompts and manual management from the automated SaaS workflow altogether.

However, as also mentioned earlier, there is a lack of understanding how to overcome some of the basic challenges that come with automation.

One of the reasons why it’s proving difficult to implement zero-touch automation is the solutions are still fairly new in comparison to global workflow management problems. In other words, the SaaS sector is still growing and we don’t really have a complete checklist of things we need to automate.

There are new offerings and newer pain points being addressed at a rapid pace. This growth is still within the IT-administered SaaS space.

That said, some SaaS companies are already working toward a solution. In fact, 69% of IT professionals are already working toward zero-touch automation as the standard.

7. 40% of IT professionals say they consolidated redundant SaaS apps (Source)

This is what slowed down the overall upward trend of SaaS adoption for 2023. At least that’s what we see if we look at the global adoption numbers from a bird’s eye view.

Collaboration within apps (and among different apps) is one of the most essential features of new SaaS software. CRMs, for example, need to allow integration with marketing, sales, and operations software, all within one platform.

Unfortunately, not many CRMs do that. This is why you have organizations choosing highly versatile platforms with almost completely open integration.

Of course, that comes with companies paying for fewer individual services and using those that allow integration of high-use systems such as communication, monitoring, and customer support.

There’s also another possible reason for this. The BetterCloud report also found that 65% of all SaaS apps are not sanctioned by IT. In other words, employees are using them without express approval of IT management.

This creates SaaS sprawl that becomes difficult for IT to manage efficiently, hence the need to consolidate all necessary services under single platforms.

8. 40% of companies using multiple SaaS apps will centralize app management via SMPs by 2027 (Source)

This will be a significant increase from less than 25% in 2022.

SaaS management platform (SMP) usage ties back to the previous point, in that companies may start to eliminate clutter and the IT-related hassle of juggling several apps. However, this statistic points to companies adopting multiple ways of managing app clutter.

While integration may be a viable option, bigger organizations need dedicated platforms for some important departments. This requires dedicated software to serve the needs of that specific department, which makes integration counterproductive.

In this case, companies may start looking to SMPs as an alternative.

However, this won’t make an impact on integration. Both integration and centralization save money, time, and other resources. Plus, it’s easier to secure operations, communications, and storage when it’s all under one roof.

Control and security are huge advantages of using SMPs. You can be sure most organizations are taking note of this going forward.

The only new thing will be the aforementioned automation, if (or rather, when) companies figure out how to implement it seamlessly.

9. The US is host to 17,000 SaaS companies (Source)

This is an average of 8x more than any other country.

The US has always been a tech powerhouse, especially in terms of customer-facing software development and innovation. However, it’s also a rich environment to test, improve, and innovate constantly.

It also helps that the US dwarfs most other markets in terms of sheer size. There are simply more companies looking to invest in more software systems. Those create more developers looking to deliver an ever-growing number of solutions.

However, the number of companies becomes staggering when you compare the next biggest markets, which are Canada and the UK. Both have only around 2,000 SaaS companies each.

In fact, if you combine these and the three that follow them (Germany, France, and India), you still don’t reach the US market size.

A major reason for this size is the strength and deep roots of the IT landscape. The US accounts for a massive portion of global software spend. Robust infrastructure encourages market growth. It makes sense why most companies see the US as their SaaS launching pad.

10. 42% of IT professionals say that managing multiple app configurations is the biggest challenge (Source)

App data visibility was the second-biggest concern, at 30%.

There are two major reasons for this:

-

- SaaS apps have a wide range of controls and settings for different groups and users to be able to work and collaborate effectively. This is great for operations and communication, but it’s complex on the IT management front.

-

- Apps must be configured on multiple levels and at several stages. They have to onboard the app into existing IT infrastructure. Then, they have set permissions and access for all employees. They also have to onboard the workforce onto the apps.

There’s also the issue of monitoring employee activity and ensuring there is no collaboration with external entities outside of company parameters.

All of these issues are compounded when there’s more than one major SaaS application running on a single network. It may not even be aware of all the apps in use, or instances of multiple duplicate use cases.

SMPs may alleviate some of these issues. However, time will tell if centralization is the only solution.

Conclusion

The last decade of SaaS development has made three things clear:

-

- There will almost always be growth in the B2B service-based software solution space.

-

- Cloud computing isn’t the future anymore, it’s the present. And as long as companies keep innovating, there will always be a market for new software.

-

- No matter how much saturation and competition is in the market, people will always look for CRM solutions that offer the perfect combination of streamlined functionality, security, and cost-effectiveness.

It just so happens that the FreeAgent CRM has everything the modern organization needs in terms of workflow management resources and more.

Try FreeAgent CRM today and discover an all-in-one project and workflow management solution that works!